pa local tax filing deadline 2021

The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties. Officially the deadline for filing local taxes remains April 15.

Pennsylvania Department Of Revenue Facebook

The IRS and PA Department of Revenue extended the tax filing deadline for the 2020 final returns to May 17 th 2021.

. This means taxpayers will have an additional month to file from the original deadline of April 15. City of Pittsburgh Extends Income Tax Filing Deadline to May 17 2021. While the usual tax return filing deadline is April 15 the deadline to file the 2021 Personal Income Tax Return is April 18 2022 per the PA-40IN 2021 Pennsylvania Personal Income Tax Return.

Find your 2021 income and tax limit from the chart in the next column. While the PA Department of Revenue and the IRS announced. Extended Tax Filing Due Date.

The 2021 Earned Income Tax annual return deadline is April 18 2022. 11 rows BLAIR TAX COLLECTION DISTRICT. March 18 2022 Harrisburg PA With the deadline to file 2021 Pennsylvania personal income tax returns a month away the Department of Revenue is extending its cus.

The new due date for 2020 Local Earned Income Tax Filings is MAY 17TH 2021. Blair County Tax Collection. All residents of Adams County and all residents of York County except West Shore School District file their annual earned income tax returns with YATB.

The Department of Revenue has announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17. The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. As of right now the Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date.

Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary. Sales Use and Hotel Occupancy Tax Pre-Payment. The deadline for filing 2021 federal and state income tax returns this year will be April 18 instead of April 15 because of a government holiday celebrated in Washington DC.

The states tax-filing deadline is tied by law to the federal deadline the department said. In addition the deadline for filing local tax returns and making local income tax payments may still be today April 15 2021. A taxpayer must report all taxable income received or accrued during the calendar year from Jan.

PA now confirming its matching IRS extension for filing 2020 tax returns to May 17. 2021 Personal Income Tax Forms. Pennsylvanians should check with their local taxing authorities to determine whether an extension has been granted.

That provision provides temporary authority to the departments of Revenue and Community and Economic Development to disregard the period after April 14 2021 and before May 17 2021 in the. The current tax year is 2021 with tax returns due in April 2022. The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021.

Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date. Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021. The deadline for filing local taxes governed by the Local Tax Enabling Act remains April 15.

The City state and federal governments are. The Bureau also collects Local Services Tax. PITTSBURGH PA March 18 2021 The City of Pittsburgh is extending its personal income tax filing deadline until May 17 in line with extensions announced by the Internal Revenue Service and the Pennsylvania Department of Revenue.

Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021. While the PA Department of Revenue and the IRS announced that income tax filing deadlines for their 2020 final returns are extended to May 17 2021 no such change has been made for the Local Earned Income Tax Filing deadline. The Department of Revenue does not have the authority to extend tax filing deadlines on the local level.

December 10 2021 Keystone is sending notices to over 249000 Pennsylvania taxpayers who appear on the tax rolls but did not file a 2020 Final Local Earned Income Tax Return by the statutory deadline. During these trying times of COVID-19 we here at Capital Tax want to wish everyone health and be safe. This means taxpayers will have an additional month to file from.

The Internal Revenue Service pushed back the filing deadline for taxes to May 17th. However Michael Herzog JD the tax expert. The Internal Revenue Service also announced earlier this.

Pennsylvania extends personal income tax filing deadline to may 17 2021.

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Sales Tax Small Business Guide Truic

/cloudfront-us-east-1.images.arcpublishing.com/pmn/5HGIEYMH75DNDA6GRD4TJ5RI6A.jpg)

Live In Pa Or N J Irs Extends Tax Filing Deadline To Feb 15 For Victims Of Hurricane Ida

Pennsylvania Department Of Revenue Facebook

Pennsylvania Department Of Revenue Parevenue Twitter

Where S My Refund Pennsylvania H R Block

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

Pennsylvania Department Of Revenue Facebook

Pennsylvania Department Of Revenue Facebook

News Keystone Collections Group

Certified Valuation Analyst In 2021 Cpa Accounting Accounting Firms Income Tax Preparation

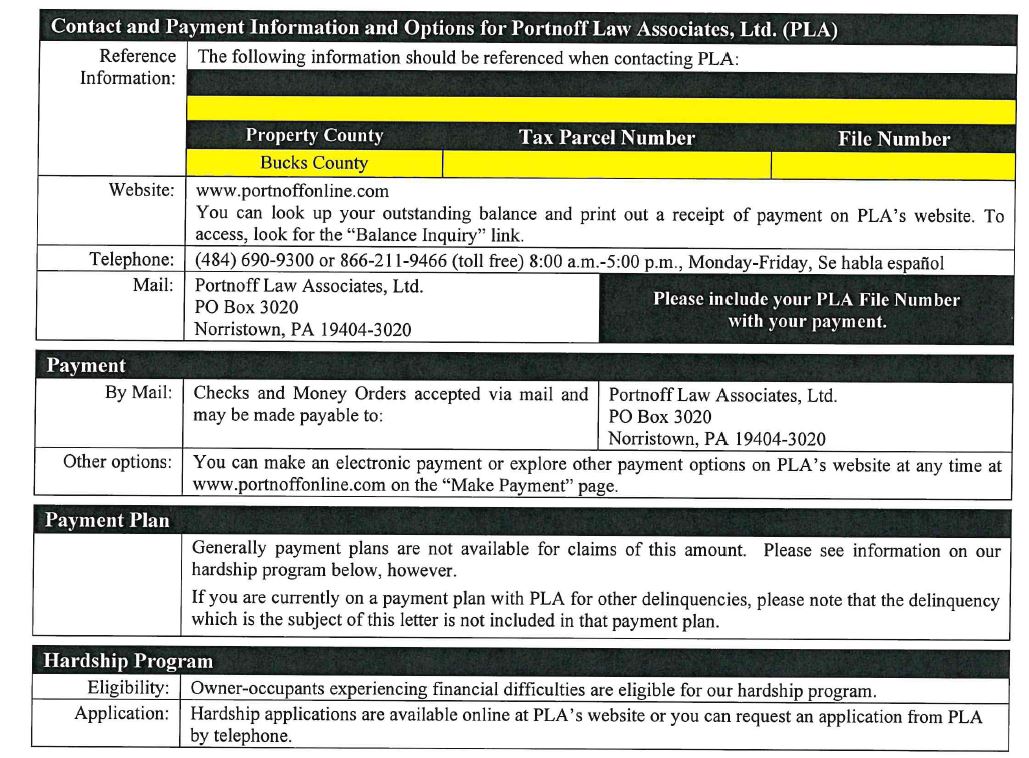

Tax Collection Warminster Township

2021 Pennsylvania Payroll Tax Rates Abacus Payroll

York Adams Tax Bureau Pennsylvania Municipal Taxes

.png)